Training: Eliminate High Interest Debt in 60 Days Or Less For Only $37!

Learn 5 Debt Optimization Methods I Use To Save Clients Over $10,000 In Yearly Interest And Cut Years Off Their Debt-Free Journey

WITHOUT EXTREME BUDGETING (THE FREEDOM PLANNER WAY)

My wife took this picture when we visited Tibet. There are too many places in the world worth seeing to stay stuck in debt. Read my letter to you below.

A Letter to You Who Are Struggling With Debt

Hi, I'm Leon. And if you're on this page, I'm going to presume that you're here because you want to eliminate credit card debt once and for all...

You're tired of living paycheck to paycheck, of wondering if you'll have enough for basic living, of all the stress and anxiety that comes with that even though your family makes 'good money.'

If that's the case, I have five proven methods that can help you optimize your debt and free up cash flow to build savings again...

If I could share not one, but five ways to cut your interest payments in half or more and eliminate credit card debt...How would that impact your cash-strapped financial situation?

To tell you exactly how these five credit card debt elimination methods work...

They work by recovering money you would have lost to big corporations. This money is then used to speed up wealth building.

I know what you're thinking, why would corporations out to maximize profits give us a way out of credit card debt?

Hold that thought, and check this out...

Sound too good to be true? My client Eryn thought that too. But that was before she saved $10,000+ in interest payments and 2+ years of being in debt.

Imagine being out of credit card debt and having another $300 or $3,000 in your bank account a month.

And the best part? Eryn only put in place ONE of the five methods I go over in this short training. Also, she is doing all this without sacrificing her lifestyle.

I'll have you know that Eryn comes from an average American family. She's a nurse with two children. Both her and her husband make a little above the average median income in America.

If it worked for her, it will work for you.

What We All Begin:

It took me weeks and months to learn reliable plans of attack for every debt situation but it was all worth it. I used to make all of the usual mistakes...

Struggling to keep track of where my money is going

Keeping track of where my money is going and realizing I don't have enough

Worrying about whether I'll be able to provide for my family

Not knowing my options for optimizing debt reduction and wealth building

Ignorant over the kind of life I can enjoy if I was more diligent with my money

But don't take my word for it...listen to Amber, who went from spending impulsively to knowing exactly how to retire a millionaire....

The key is: if you handle your debts, you can retire a millionaire too.

The thing is, without a method for eliminating high interest debt, you're toast. You'll struggle to succeed without it. Yet, in this training I give you not one but five methods for eliminating high interest debt.

And if you're thinking, "why haven't I heard of these methods to delete credit card debt before..."

It's because school doesn't teach personal finance and banks make the most money on debt.

Most people's only way to tackle credit card debt is by living like they're broke. Why are you doing what they do?

With these five debt optimization methods, you can escape being slaves to corporations. You can be generous with those you love. You can look forward to a brighter future.

There's NOTHING stopping you from turning your life around. Listen, can I please share these five methods with you?

Imagine you learned the best ways to optimize your debt. Imagine life without credit card debt. Imagine going on that vacation, and still having enough cash to live the life you deserve.

Picture yourself not having to make payments to some corporation. Instead, you're saying yes to your self-care routine or your children's extra-curriculars.

How would that impact your relationships? Your confidence? Your mental health?

Would you like to get these five debt optimization methods along with my personal help? If so, this training outlines exactly how each method works.

By the end of it, you'll be ready to grow your bank account again. But what you're receiving isn't the ability to become debt-free, you're regaining control. You're regaining the confidence to pursue financial independence and live an abundant life.

You're becoming a freedom planner.

You CAN get out of debt without extreme discipline and unsustainable budgets.

And no, these five debt optimization methods is not confusing or too detailed. They're the exact strategies I share with my clients to get results like Eryn did. If she can do it, why can't you?

Your job is simple. Learn these five methods. Apply your favorite(s). Destroy high interest debt. Live your best life. So what are you waiting for? Join now...

What You Get:

As soon as you've joined the course, you will have instant access to the training. This is the exact traning I give my clients who struggle with managing high interest debt. You'll learn how to:

Slash Your Debt Fast – Use proven techniques to decimate credit card balances

Choose the Right Strategy – Identify the best debt elimination method for your situation

Automate Your Finances – Create a seamless system to manage cash flow and stay debt-free

You'll also get a few bonuses worth more than the training itself for FREE:

Bonus #1 Free Vendor List – No more shopping around and indecision. Whether you're in the US, Canada, UK, New Zealand or Australia, you'll get a resource list so you can start reducing your debt right away

Bonus #2 30-Day Credit Score Recovery Email Course – Learn 30 ways to improve your credit score to qualify for loans on better terms. Save a ton of money on your next mortgage or loan, and be in a better position to negotiate with lenders

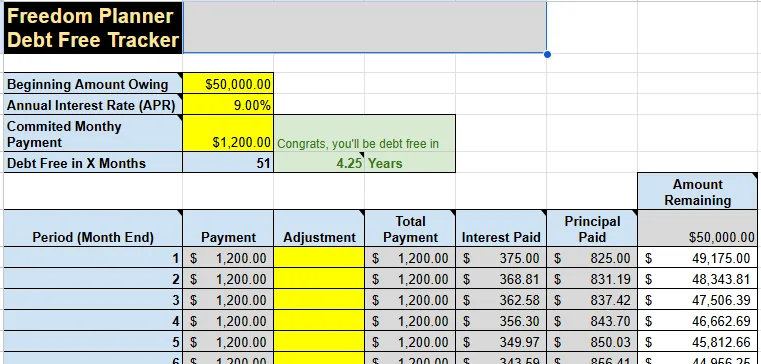

Bonus #3 Free Debt Free Tracker – No more uncertainty. Plug your numbers in to know exactly when you will pay off each debt with my easy-to-use tracker (screenshot below)

You'll also receive an invitation to chat with me to get even more targeted help building a complete cash flow management system.

And if all that value isn't enough, if none of the strategies work for you, we offer a

100% money-back guarantee making your investment 100% risk-free.

This training either decreases your debt burden or you get your money back.

Your success and results are the only priorities. So what are you waiting for? Let's get you started.

Note: I can't share these five debt optimization methods forever. I pride myself on providing the absolute best service to my clients. That's why I can only do that for a limited number of people at a time.

In fact, one of my goals of providing this low-priced training because to connect with people I can help.

That said, I can only take on 3-5 new 1-on-1 clients per month because I want to uphold a high standard of service. After all, I'm a father and husband first and not some online business guru.

I make that promise to you, like how I've made it to my other clients. That's why I always remove this training from sale whenever I hit my monthly client capacity.

So don't wait to join me in eliminating all your credit card or high interest debt.

Though if you'd prefer to carry on making endless payments to the big banks, I can't stop you.

If you'd prefer to carry on living paycheck to paycheck, not having enough money for an emergency, or with that feeling of impending doom from not having your finances together... I can't stop you doing that, either.

What I can do is help you cut credit card debt and interest payments without forcing upon you an extreme budget.

If you'd prefer the second option, then click on the button below now. The worst that can happen is you get your money back after learning five ways to optimize debt.

STILL NOT SURE?

Frequently Asked Questions

We understand that you still may have questions, here are the most common ones.

Who in the world are you?

Always good to learn a little bit more about someone on the internet that you might be paying. I'm Leon. I started my career by studying accounting and finance, but soon realized that I had a passion for education so I pursued a second degree in business education at the University of British Columbia. For the last decade, I've been teaching business and economics internationally and am currently a department head at one of the best high schools in the world. Some of the schools my students have gotten into include UCL, Cambridge, and UCLA.

Why are you even a finance coach?

I've always been passionate about personal finance education and I've helped many of my teacher-friends throughout the years. My wife has always encouraged me to help others but it wasn't until late 2023 when my father-in-law was diagnosed with cancer that I realized how fragile life really was, and how many of us let companies take advantage of us because we simply don't know. It sounds cheesy, but I'm in financial coaching because I want to make a difference. I want to help others give their loved ones the life they deserve while doing the same for my own family as well. Before I'm a teacher or coach, I am first and foremost a husband and father.

What do I get for $37?

Lifetime access to a video training that goes over 5 proven methods for debt optimization, as well as a list of service providers to get you started. For a week's worth of Starbucks, eliminate high interest debt forever.

Are there any hidden fees?

No.

How do I know this will work for me?

It will work for you as long as you have high interest debt and implement the training. And if for some reason you implement and it doesn't work (which shouldn't happen), email [email protected] with the email you used to pay and I'll issue you a full refund.

CHECKOUT PROCESS

TRY IT RISK FREE

100% Money Back Guarantee

If you attempted the debt optimization methods and none of them saved you ANY money, email [email protected] within 7 days with the email you used to pay and I'll gladly give you a full refund.

Copyright © 2024 King Educates, All Rights Reserved. This site is not a part of the Facebook™ website or Facebook™ Inc. Additionally, this site is NOT endorsed by Facebook™ in any way. FACEBOOK™ is a trademark of FACEBOOK™, Inc

Terms | Disclaimer | Privacy